BABA Stock Downgrade: What it Means and the Internet's Reactions

AI Downgrades Alibaba? I See a Revolution Brewing

So, an AI analyst at TipRanks, using the OpenAI-4o model, just downgraded Alibaba (BABA) stock from "Buy" to "Neutral," and trimmed the price target. AI Analyst Downgrades Alibaba Stock (BABA) to Hold and Trims Price Target Despite Wall Street Optimism The headline makes it sound like a setback, right? Wall Street's still bullish, projecting almost 24% upside, while this AI sees only 8.23%. But here's the thing: I think this "downgrade" is a massive signal—a flashing neon sign pointing to the real revolution happening beneath the surface. This isn't just about Alibaba; it's about the dawn of AI-driven insights disrupting the very foundations of how we understand value and potential in the market. When I saw this, I had to just sit back and think about how far we have come.

The AI Oracle's Gaze

Let's be clear: AI isn't replacing human analysts anytime soon. But what if it's starting to augment them in ways we haven't fully grasped? TipRanks' AI Stock Analysis gives Alibaba a score of 69 out of 100, citing strong financials offset by bearish technical indicators and valuation concerns. Okay, that's a balanced view. But the speed at which this AI can process data, identify patterns, and adjust its outlook is frankly, staggering. It's like having a hyper-caffeinated research team working 24/7.

This AI isn't just crunching numbers. It's combining insights from multiple models, including OpenAI’s GPT-4o and Google’s Gemini. It's a symphony of silicon, a chorus of algorithms harmonizing to produce a single, data-driven verdict. And it's not always going to align with human sentiment, and that is a good thing.

Here's where it gets interesting. The AI highlights Alibaba's strengths: growth in AI and cloud services, strong Q1 FY26 results (revenue reaching 247.7 billion yuan, cloud sales climbing 26% year-over-year), and strategic partnerships. These are all huge positives. But it also flags weaknesses: weak free cash flow, losses in the quick-commerce business, and rising debt. These are the very real challenges that could limit Alibaba's near-term flexibility.

Now, imagine you're an investor trying to weigh these factors. You're bombarded with opinions, news articles, and market noise. How do you cut through the clutter? This AI provides a concise, data-backed assessment. It's not saying "sell everything!" It's saying, "Hey, here are the risks, here are the rewards, make an informed decision."

The quick-commerce business losing money? That's a problem. Alibaba's collaboration with SAP expanding its global reach? That's a major opportunity. How does one weigh the two?

Is this AI always right? Of course not. But it's offering a crucial counterpoint to the prevailing optimism. It's forcing us to confront the potential downsides, the hidden risks that might be obscured by the hype. And that's invaluable. It's like having a built-in devil's advocate, constantly challenging our assumptions.

Beyond the Numbers: A New Era of Investing

This isn't just about Alibaba; it's about a fundamental shift in how we approach investing. We're moving towards a world where AI-powered insights are readily available to everyone. No more relying solely on gut feelings or biased opinions. We can leverage the power of AI to make more informed, data-driven decisions.

Consider the implications for other companies. What if an AI analyst downgraded Tesla (TSLA) because of concerns about production bottlenecks or rising competition? What if it flagged potential risks for Amazon (AMZN) due to increased regulatory scrutiny? The possibilities are endless.

This is the kind of breakthrough that reminds me why I got into this field in the first place.

But let's not get carried away. We also need to consider the ethical implications. Who controls these AI models? How transparent are their decision-making processes? How do we prevent bias from creeping into the algorithms? These are crucial questions that we need to address as this technology evolves.

The community is already buzzing about this. I saw one comment on Reddit saying, "This is just the beginning. Soon, AI will be managing entire portfolios." Maybe that's a bit extreme, but it speaks to the growing excitement and anticipation surrounding AI in finance.

The AI is not always correct, but this is a massive step.

AI: The Great Equalizer?

Ultimately, this AI "downgrade" of Alibaba is not a cause for alarm. It's a sign of progress. It's a glimpse into a future where AI empowers investors of all levels to make smarter decisions. It's a future where data trumps hype, and where informed analysis prevails over blind faith. The speed of this is just staggering – it means the gap between today and tomorrow is closing faster than we can even comprehend. Will Alibaba prove the AI wrong? Only time will tell. But one thing is clear: the game has changed.

The Future Is Arriving

Related Articles

Adrena: What It Is, and Why It Represents a Paradigm Shift

I spend my days looking at data, searching for the patterns that signal our future. Usually, that me...

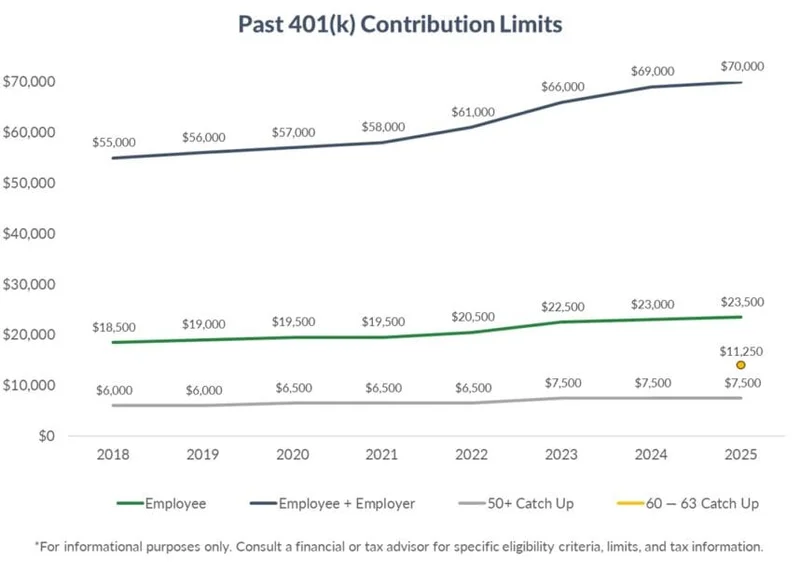

401k Contribution Limits Soar in 2026: What It Means For Your Future – Investing

Alright, buckle up, folks, because the IRS just dropped some news that's got me practically buzzing...

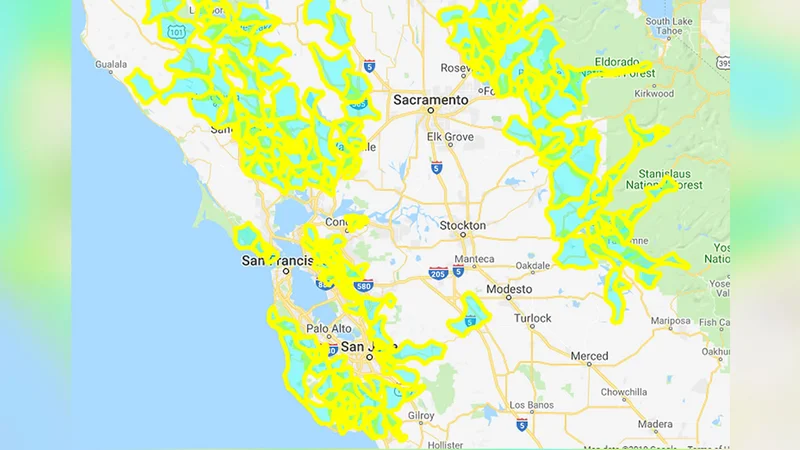

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

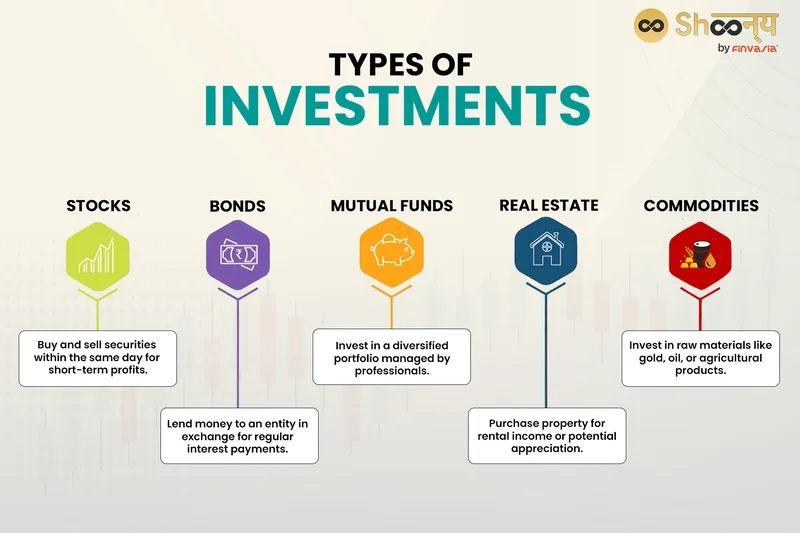

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

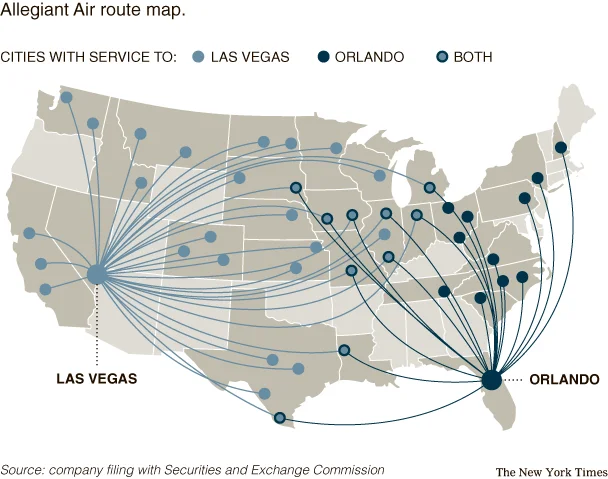

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...

Nvidia: GPU Depreciation and China Export Curbs

Title: AI's Insatiable Appetite: How Nvidia's China Chip Ban Could Backfire The race to dominate the...