401k Contribution Limits Soar in 2026: What It Means For Your Future – Investing

Alright, buckle up, folks, because the IRS just dropped some news that's got me practically buzzing with excitement! Forget those doom-and-gloom headlines for a minute; this is about you and your future. Seriously, when's the last time the IRS gave us a reason to feel this optimistic?

They've just announced the 2026 contribution limits for 401(k)s and IRAs, and let me tell you, it's like they've given our retirement savings a shot of rocket fuel. We're talking about a chance to supercharge our nest eggs, and I'm here to tell you why this isn't just about numbers – it's about reclaiming control of our future.

The Future is Now: Retirement Reimagined

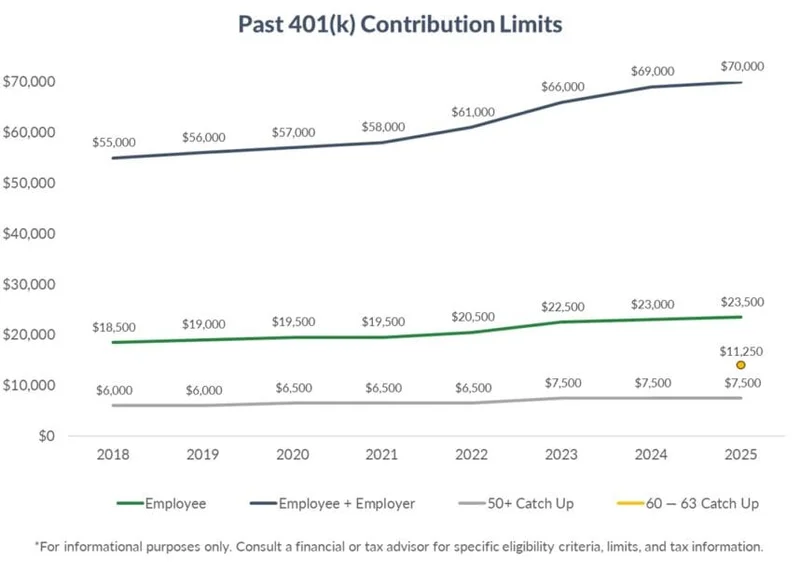

For those diligently stashing away money in their 401(k)s, the annual contribution limit is jumping to $24,500, a full $1,000 increase. And for those age 50 and over, the "catch-up" contribution leaps to $8,000, enabling a total contribution of $32,500. It's like finding an extra gear when you thought you were already maxing out! Then there's the "super catch-up" provision for those aged 60-63, who can still contribute up to $11,250, bringing their potential total to a whopping $35,750. New IRS Rules for 2026 Will Allow You to Contribute More to Your 401(k) and IRA

But here's the thing: this isn't just about the extra cash. It's about the opportunity it unlocks. Think of it like this: for years, we've been told to tighten our belts, to brace for uncertainty. But what if, instead, we could proactively build a future we're excited about? What if we could turn the tables and use the system to our advantage? The increased limits on IRA contributions, now at $7,500 with a catch-up of $1,100 for those 50 and over, provide even more avenues for securing our later years.

It’s easy to get bogged down in the details of inflation rates and cost-of-living adjustments, but that's missing the forest for the trees. The IRS uses the CPI to adjust these limits, and while inflation has been a thorn in our side, it's also the very reason these contribution limits are increasing. It's a double-edged sword, sure, but we can use it to sharpen our financial strategies.

This reminds me a bit of the early days of personal computing. Remember when computers were these massive, intimidating machines that only experts could use? Then came the personal computer, and suddenly, everyone had the power of computation at their fingertips. This is similar: retirement planning used to feel like a daunting, complex task best left to the "experts." But with these increased contribution limits, we're being given more tools to take control and shape our own financial destinies.

Now, I know what some of you might be thinking: "That's great, Aris, but who can actually afford to max out their 401(k)?" And that's a fair question. But here's the thing: even small increases can make a big difference over time, thanks to the magic of compounding. And for those who can swing it, this is a golden opportunity to accelerate their savings and potentially retire earlier, or with a more comfortable cushion. Plus, contributing to a 401(k) lowers your taxable income, which is always a plus. It's like getting paid to save for your future!

This isn't just about individual gain, either. It's about building a more secure future for all of us. When more people have the resources to retire comfortably, it reduces the strain on social safety nets and creates a more prosperous society for everyone. It's a win-win! I saw a comment on a Reddit thread that really resonated with me: "Finally, some good news! Feels like we're being given a chance, not just told to worry." That's the spirit! That's the collective excitement I'm talking about.

Of course, with great power comes great responsibility. We need to be mindful of where we're investing our money, to ensure we're making informed decisions that align with our values and goals. And we need to advocate for policies that make it easier for everyone to save for retirement, not just those who are already well-off.

Is This the Dawn of a New Era of Financial Empowerment?

So, what does this all mean? It means we have a chance to redefine what retirement looks like. It means we can be more proactive, more empowered, and more in control of our financial futures. It’s not a magic bullet, and it won't solve all our problems, but it's a step in the right direction. And honestly, after years of feeling like we're constantly playing catch-up, it's a breath of fresh air. It reminds me why I got into this field in the first place.

The IRS has just given us a powerful tool. Now, it's up to us to use it wisely and build the future we deserve.

Previous Post:Hong Kong: Robot Test?

Next Post:Space Moonshots and Turbulence: What's Really Going On

Related Articles

The 10-Year Treasury Yield: Why It's the Real Thing Screwing With Your Mortgage, Not the Fed

So You Think the Fed Controls Your Mortgage Rate? Think Again. Let me guess. You saw the headlines i...

IRS Direct Deposit Stimulus: The Truth About the October 2025 Payment

That $2,000 IRS Stimulus Check? It's Not Real, But The Rumor Itself Is Telling Let’s be clear, becau...

GME: White House Social Media Repost vs. Earnings Expansion

Generated Title: GameStop: Meme Stock Mania or Calculated Comeback? The Data Tells a Different Story...

John Malkovich Cast as President Snow: An Analysis of the Casting and Its Implications

The announcement landed with the precision of a well-funded marketing campaign. The Hunger Games, a...

Julie Andrews: Why Her Legacy Endures Beyond Her Iconic Voice

I spend my days analyzing systems. I look at code, at networks, at AI, searching for the elegant des...

RGTI Stock: A Comparative Analysis vs. IONQ and NVDA

The market action surrounding Rigetti Computing (RGTI) in 2025 presents a fascinating case study in...