Stock Market Dive: Tech Selloff and What's Driving the Panic

Alright, let's get straight to it. The market took a tumble this week, and the headlines are predictably dramatic. We're seeing red across the board: the Dow down, the S&P 500 slipping, and the Nasdaq taking a hit, especially among tech stocks. But before we all start panic-selling our meme stocks, let’s dig into the numbers and see if this is a genuine cause for alarm or just another Tuesday.

The Fed's Shadow and China's Slowdown

The immediate trigger seems to be a one-two punch of hawkish Fed talk and disappointing economic data out of China. Minneapolis Fed President Neel Kashkari's comments about persistent inflation clearly spooked the markets. Traders are now pricing in a significantly lower probability of a December interest rate cut – less than 50%, down from 95% just a month ago. That's a seismic shift in expectations, and the market hates uncertainty.

Then you have China. Retail sales rose only 2.9% in October, the slowest pace since last year. Industrial production climbed 4.9%, the smallest increase since January. Fixed-asset investment dropped 1.7% year over year. These aren't numbers that inspire confidence. The knee-jerk reaction is to sell, sell, sell. But let's look closer. Are these isolated data points, or are they indicative of a deeper, more systemic problem? And, perhaps more importantly, is the market overreacting?

Here's where things get interesting. We also have the tail end of that government shutdown to consider. The six-week data vacuum it created has left everyone, including the Fed, flying a bit blind. The October jobs report and inflation data are MIA, which means the Fed is making decisions based on incomplete information. This begs the question: how much of the market's reaction is based on real economic indicators versus perceived risk amplified by a lack of data? It's hard to say definitively.

The Crypto Factor and Sector-Specific Shocks

Don't forget about the crypto chill. Bitcoin's drop below $96,000 (a 23% drop from its October peak) is dragging down token-linked stocks. The bloom is off the rose, and investors are pulling cash from crypto ETFs. The interesting detail is, the number of long-term holders have sold about 3000 BTC in the past month. That's the largest long-horizon selloff since early 2024.

And then there are the individual stock stories. Walmart's stock dipped 2.2% on the news of CEO Doug McMillon's upcoming retirement. Applied Materials shares dropped 6.3% after forecasting weaker China spending. Cidara Therapeutics, on the other hand, more than doubled after Merck announced a $9.2 billion acquisition. These are sector-specific and company-specific events, not necessarily indicators of a broader market collapse. US Stock Market today: Wall Street key indices slump on renewed tech selloff, Walmart dips 2.2%

I've looked at hundreds of these reports, and the real story isn't always on the surface. It's buried in the footnotes, in the subtle shifts in language, in the discrepancies between the headline numbers and the underlying data. What strikes me as odd is the market's seeming inability to differentiate between systemic risk and isolated incidents.

The market’s reaction seems disproportionate to the news. The Fed's caution is understandable given the data gaps, and China's slowdown was already priced into many forecasts. The market is behaving like a hyper-sensitive seismograph, reacting to every tremor as if it were the Big One.

Is This a Buying Opportunity?

So, what's the takeaway? Is this a buying opportunity, or should we all be heading for the hills? The honest answer is: it depends. It depends on your risk tolerance, your investment horizon, and your ability to stomach volatility. But from a purely data-driven perspective, this dip looks more like a correction than a crash. The underlying economic fundamentals (while uncertain) aren't as dire as the market's reaction suggests.

The key, as always, is to do your own due diligence, look beyond the headlines, and make informed decisions based on your individual circumstances. Don't let fear or greed drive your investment strategy. And remember, in the long run, the market tends to reward those who stay calm and rational in the face of short-term volatility.

The Market's Got a Case of the Nerves

In conclusion, this isn't a sign of the apocalypse. It's a market overreacting to a confluence of factors, amplified by uncertainty and fear. The data is noisy, but it doesn't scream "sell everything." Stay calm, stay informed, and don't let the market's jitters cloud your judgment.

Related Articles

The 10-Year Treasury Yield: Why It's the Real Thing Screwing With Your Mortgage, Not the Fed

So You Think the Fed Controls Your Mortgage Rate? Think Again. Let me guess. You saw the headlines i...

Netflix Stock: What's Behind the Price Swings and the Split?

Netflix's Stock Split: A Springboard to a Billion New Stories? Netflix's recent 10-for-1 stock split...

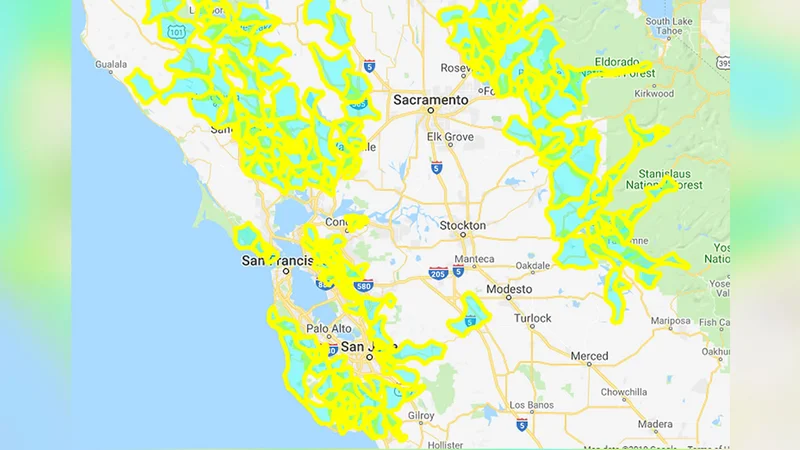

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

Plug Stock's Big Jump: What's Actually Happening and Why You Shouldn't Buy the Hype

So, Plug Power is back. Just when you thought the stock was destined to become a footnote in the ann...

Nvidia: GPU Depreciation and China Export Curbs

Title: AI's Insatiable Appetite: How Nvidia's China Chip Ban Could Backfire The race to dominate the...

Gold Price Analysis: Today's Price, Key Metrics, and the Silver Correlation

Gold's Dizzying Climb to $4,000: A Sober Look at the Numbers Behind the Hype The numbers flashing ac...