Costco Stock: Today's Price — And Why It's (Probably) Not What You Think

Costco's Price Tag: Who's Drinking the Kool-Aid Now?

Alright, let's talk about Costco. Everyone’s favorite bulk-buy paradise, right? The place where you go in for paper towels and leave with a flat-screen TV, a 5-pound tub of peanut butter, and a hot dog combo that’s still stuck in 1985. But while you’re pushing that overloaded cart, take a peek at the stock. Because right now, Costco Wholesale (NASDAQ: COST) is looking less like a treasure hunt and more like a high-stakes game of "chicken" on the stock market.

The ticker's been wobbling around $890 recently, down a solid 15% from its 52-week peak. We’re talking $1,078 to under $900 in what feels like a blink. That ain't pocket change. It’s shed 11% in six months, clinging by its fingernails just above a new 52-week low. So, is this the "buy the dip" moment everyone’s been salivating over for an "elite business," or is it just the first crack in a ridiculously overinflated balloon? Me? I'm leaning toward the latter, and honestly, who's surprised?

The Valuation Delusion: Are We High?

Look, I get it. Costco's a good company. Their business model is slick – those membership fees practically print money, letting them keep prices down and make you feel like you're getting a deal. They've got over 130 million members, renewal rates north of 90%, and Kirkland Signature is basically a religion. But none of that, and I mean none of it, justifies the price tag on this stock.

We’re staring down a trailing P/E of around 50. Fifty! Think about that for a second. The forward P/E is 44.56. And the PEG ratio? Don't even get me started. We're talking 3.8 to 5.5 depending on whose magic eight-ball you're shaking. That’s not just "high," folks. This isn't just overpriced; no, 'overpriced' is too polite—it's a financial black hole waiting to swallow your cash if you aren't careful. It’s like paying Ferrari prices for a slightly used minivan just because it has good cup holders. Sure, it gets the job done, but at what point do you realize you've been taken for a ride?

Even with their Fiscal Q4 2025 revenue up 8.1% to $86.16 billion and EPS jumping 14%, a 3% net profit margin and a 0.6% dividend yield simply don't scream "premium growth stock" at a 50 P/E. That dividend is a joke, a token gesture while they rake in billions. You'd get a better return stuffing your cash under a mattress, probably. And don't even try to tell me those October sales, up 8.6%, are suddenly going to launch this thing to the moon. Single-digit growth, however consistent, just doesn't cut it when the market expects you to be the next Nvidia stock, defying gravity.

The real money, the "whales" playing in the options market, they're leaning bearish. On November 19, we saw $1.45 million in put options against a paltry $156,000 in calls. That tells you something, doesn't it? When the big boys are placing bets that the stock will drop, maybe, just maybe, they know a thing or two the Wall Street cheerleaders aren't screaming from the rooftops.

And speaking of cheerleaders, let’s talk about Jim Cramer. The man's out there on CNBC, pounding the table, calling Costco one of his "favorite names" and swearing he'll never sell it from his charitable trust. Bless his heart. While Cramer's busy gushing, the actual stock market is quietly, steadily, repricing this "elite" name. It’s classic Cramer, isn’t it? The retail investor hears that, jumps in, and then wonders why their portfolio looks like a forgotten shopping list. Then again, maybe I'm the crazy one here.

The Great Repricing: Where Do We Go From Here?

So, where does this leave us? Wall Street's consensus is still "Moderate Buy" with an average target around $1,025. Are they living in a different dimension? The stock is trading almost 15% below that target right now, and the underlying valuation metrics are screaming "danger." It's like they're looking at a painting that's clearly peeling and faded, but insisting it's still a masterpiece because it used to be.

Analysts like David Jagielski at The Motley Fool are actually showing some sense, advising against a rush to buy and suggesting it for a watchlist, expecting further decline. Stuart Allsopp from Seeking Alpha is echoing the "extreme" PEG ratio warnings. These guys are pointing out the obvious, which, offcourse, gets drowned out by the noise of "buy the dip!" and "long-term winner!"

Costco's had a fantastic run, no doubt. Over the last five years, shares are up more than 150%, even after this recent slide. But that's exactly the problem. The stock has historically traded at a high valuation, peaking over 60x earnings. It's built on the expectation of perpetual, aggressive growth that just isn't there anymore. It’s like a sprinter who’s been setting world records for years, and now they’re consistently running respectable, but not record-breaking, times. You can't keep paying for world records when they're not happening.

The RSI indicators are whispering "oversold," which for some, is a signal to jump in. But honestly, in a market where tech giants like Amazon stock, Apple stock, or even Microsoft stock have seen their own moments of brutal repricing, thinking Costco is somehow immune to gravity because it sells bulk toilet paper is just wishful thinking. The institutional investors are mixed, some buying, some trimming. Even Senator John Boozman (R-Arkansas) made a small personal purchase. Small. Not exactly betting the farm.

This isn't about whether Costco is a good company. It is. It's about whether Costco stock is a good investment at this price, in this market. And right now, it feels like we're watching a slow-motion correction. The market is finally starting to sober up and realize that even the best businesses can be wildly overvalued.

Wake Up and Smell the Coffee (from the Bulk Aisle)

This whole "buy the dip" narrative for Costco is a trap. It's a classic case of hoping past performance, however stellar, can indefinitely justify future fantasy. The stock isn't "on sale" when it's still trading at 50 times earnings. It's just less ridiculously overpriced than it was. Don't fall for it. There's more pain to come if the market truly decides to reprice these high-multiple growth stocks. Stick to your watchlist, because a real bargain ain't here yet.

Previous Post:Morocco: Unveiling Its Bold Technological Future and Inspiring Breakthroughs

No newer articles...

Related Articles

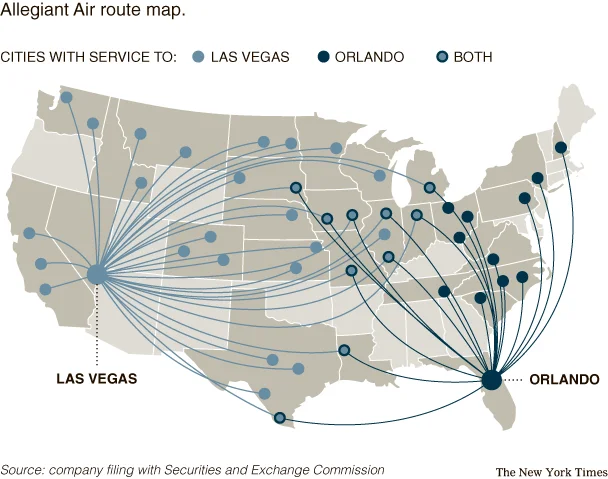

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...

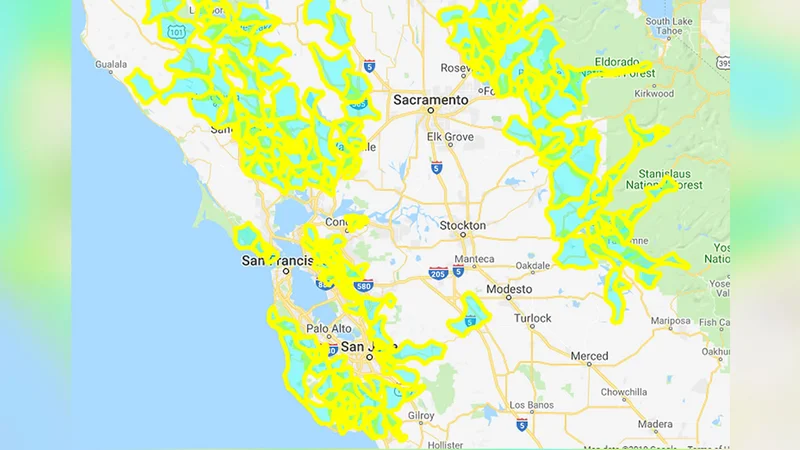

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

Fed's Latest Minutes: What the Data Reveals About Rate Cuts and Internal Disagreement

The Federal Open Market Committee just released the minutes from its September meeting, and if you w...

GOOGL Stock: Berkshire Hathaway's $4.3B Bet and What It Means for Tech Investors

Buffett's Bet on Google: A Quantum Leap for Value Investing? Warren Buffett, the Oracle of Omaha, bu...

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

Gold Price Analysis: Today's Price, Key Metrics, and the Silver Correlation

Gold's Dizzying Climb to $4,000: A Sober Look at the Numbers Behind the Hype The numbers flashing ac...