Avelo Airlines Flights: Routes, Cancellations, and What's Behind the Changes

Avelo's Expansion: A Risky Bet on Secondary Markets?

Avelo Airlines is making some aggressive moves, adding new routes from Wilmington (ILG) to Atlanta (ATL) and Chicago (ORD) slated for early 2026. Five weekly ATL flights starting February 12th, and four ORD flights from March 12th, with one-way fares advertised from $34. Avelo's CEO, Andrew Levy, claims this reflects "strong and continued demand in Greater Philadelphia for low-cost and reliable flights." But is it really demand, or just price sensitivity?

The airline is also adding a third aircraft to its Wilmington base by March 2026, as well as a second to Lakeland, Florida. On the surface, this looks like growth. But digging a little deeper, a few things don't quite add up.

The ICE Contract Question

Avelo's strategy isn't just about connecting smaller markets. There's also the elephant in the room: their contract with ICE. Since May, Avelo has been operating charter flights for Immigration and Customs Enforcement, transporting detainees. This has sparked protests at Baltimore-Washington International (BWI), where Avelo operates a limited number of passenger flights.

According to the Maryland Aviation Administration, Avelo handled just over 36,000 passengers at BWI in fiscal year 2025, which is only 0.14% of all airport passengers. The ICE contract, according to media reports, was a means to keep its passenger service afloat.

Now, here's where my skepticism kicks in. Avelo claims its expansion reflects organic demand, but the timeline suggests the ICE contract might be propping up the airline's broader operations. Consider this: prior to May 2025, one of Avelo's Boeing 737s (tail number N804VL) primarily flew to and from Connecticut. Since then, it's been all over the country, and even to Central America. A flight from Phoenix to Baltimore, then to Alexandria, Louisiana (a major ICE deportation hub) on May 31st raises questions.

Could it be that the new routes and base expansions are partially fueled by the guaranteed revenue from ICE, allowing Avelo to take on more risk in passenger markets? It's difficult to say without knowing the exact financials of the ICE contract (which, unsurprisingly, Avelo hasn't disclosed). But if that revenue stream dries up—either through public pressure or policy changes—what happens to those new routes?

Secondary Airports: Opportunity or Trap?

Avelo's focus on smaller, secondary airports like Wilmington is a double-edged sword. On one hand, they avoid the congestion and higher costs of major hubs. Levy notes that most Avelo routes include at least one small, convenient airport, theoretically offering a "smoother, easier and more enjoyable experience." On the other hand, these markets often have lower passenger volumes and more price-sensitive customers.

The airline is banking on stimulating demand with low fares (starting at $34), but that only works if they can maintain consistently high load factors. And that’s a challenge. Avelo is now serving 16 nonstop destinations from Wilmington. How many of those routes are actually profitable, and how many are subsidized by more successful routes or, again, the ICE contract?

Avelo launched new Chicago routes from both Wilmington and Charlotte. It's also returning routes to Atlanta and Nashville. This creates a complex web of overlapping services. The question isn’t just whether there’s demand for a flight to Atlanta from Wilmington, but whether there's enough demand to sustain five weekly flights, especially when Avelo is also offering Atlanta flights from Lakeland and Nashville. Avelo Launches New Chicago, Atlanta and Nashville Routes

And this is the part of the report that I find genuinely puzzling: the Redmond, Oregon to Burbank, California flights are ending earlier than expected. What does that tell us? It tells us that, if Avelo is willing to cut a route, they will. What happens to Wilmington when the numbers don't add up?

So, What's the Real Story?

Avelo's expansion is a high-stakes gamble. The airline is betting that low fares and convenient airports can unlock untapped demand in underserved markets. But it's a strategy that relies on a delicate balance of factors: sustained low fuel costs, high load factors, and a continued revenue stream from somewhere. My analysis suggests that without the ICE contract, Avelo's expansion could be a house of cards waiting to collapse.

Related Articles

The QQQ ETF: A Clinical Look at Its Performance and Future Outlook

Is the 'Smartest AI ETF' Just a Tech Index in Disguise? There’s a headline making the rounds that’s...

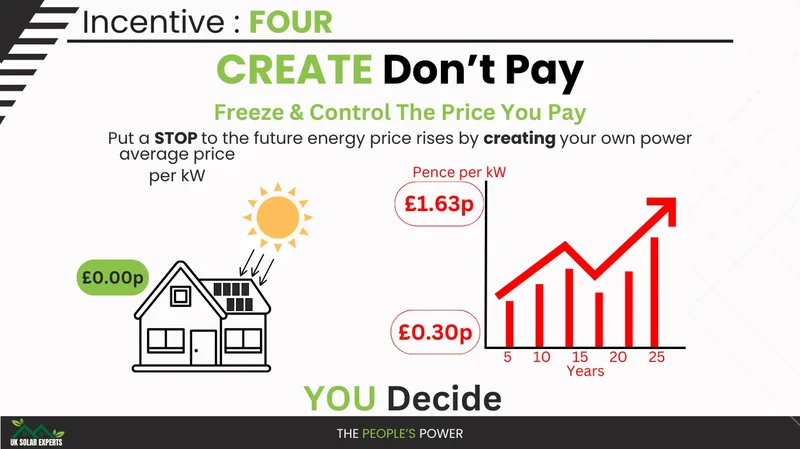

Federal Solar Incentives Are Ending: A Data-Driven Breakdown of the Financial Impact

Oregon Governor Tina Kotek is in a race against the clock. With an executive order, she has directed...

mstr stock: Bitcoin Buys, Crypto Crashes, and the Big Picture

Saylor's Bitcoin Bet: Is MicroStrategy a Genius Play or a Ticking Time Bomb? MicroStrategy and Bitco...

Fifth Third Swallows Comerica for $10.9B: Why It's Happening and Why You Should Care

So, another Monday, another multi-billion dollar deal that promises to "create value" and "drive syn...

Netflix Stock: What's Behind the Price Swings and the Split?

Netflix's Stock Split: A Springboard to a Billion New Stories? Netflix's recent 10-for-1 stock split...

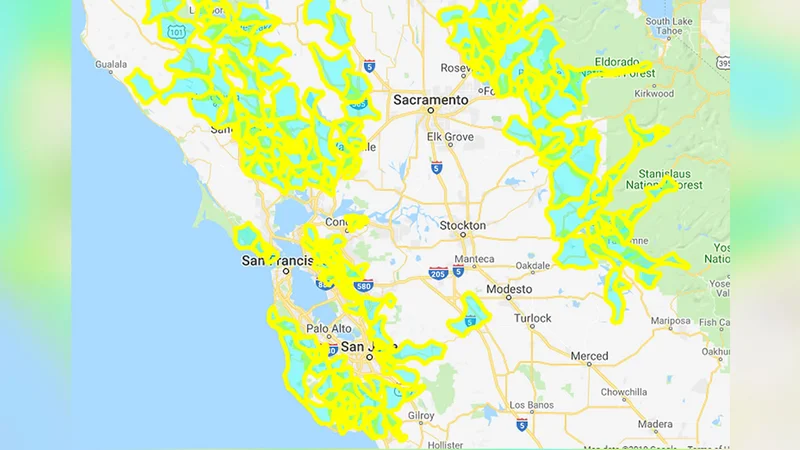

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...